A question that has come up recently from many in the tech industry is the non-compete price of joining a cloud titan worth it?

Werner Vogels, Amazon CTO caught a lot of flak for this tweet:

Dare, I appreciate your sentiment, but I knew exactly what contract I signed 17 years ago, which included a 6-12 month vacation if I wanted to join another major tech company. I was fine with it then, and still am now. No IQ test needed. https://t.co/646zoqHiPI

— Werner Vogels (@Werner) September 16, 2021

With well-known influencers like Liz Fong-Jones, Joe Beda and Corey Quinn pushing back and telling this is spoken from deep within privilege.

This coming hot on the heels of two recent ex-exec acquisition attempts, one is Peder Ulander (and Matt Asay) going to MongoDB, and Microsoft’s attempt to buy out Charlie Bell’s non-compete so he can head up Azure’s security.

Frederick von Chipenheimer IV Reigns Supreme – With Some Disgruntled Employees

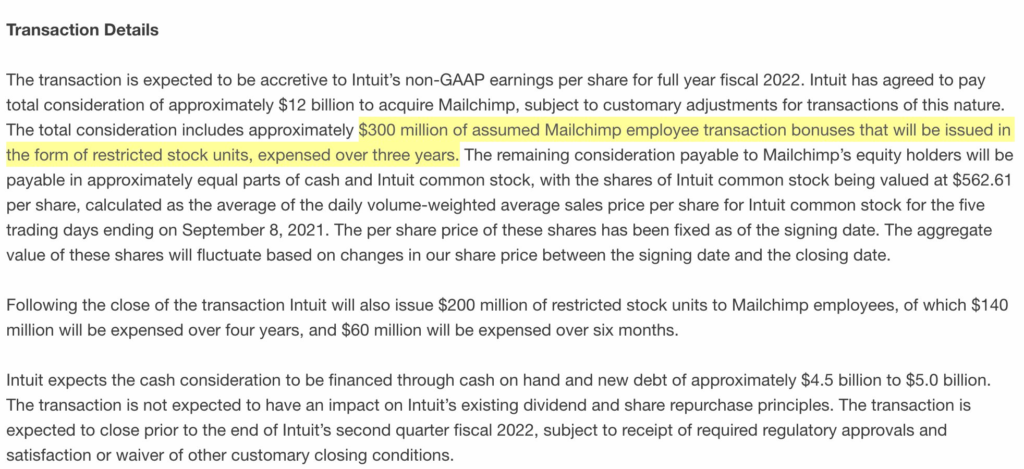

Huge acquisition of Mailchimp by Intuit, in a $12B deal – for a company that is completely bootstrapped, making this the largest acquisition of a privately held zero-funding company to date. This also came with quite a bit of controversy around employee rights and equity – where no employees hold any equity only profit-sharing incentives, an interesting thread on the topic,

<blockquote class=”twitter-tweet”><p lang=”en” dir=”ltr”>Mailchimp just got bought for $12 billion, and employees own no equity <a href=”https://t.co/RET79x5v33″>https://t.co/RET79x5v33</a></p>— Ellen K. Pao (@ekp) <a href=”https://twitter.com/ekp/status/1437516618553192449?ref_src=twsrc%5Etfw”>September 13, 2021</a></blockquote> <script async src=”https://platform.twitter.com/widgets.js” charset=”utf-8″></script>

A total of $300M will be allocated to the 1200 employees in RSUs over three years. Ouch.

Introducing UNICORN FUNDING ROUNDS!

As if the venture capital and tech industry hasn’t gone crazy enough, with what some claim to be unwarranted and overly exaggerated valuations, this month saw one of the wildest funding rounds in history with Databricks raising $1.6B (yes, you heard correctly RAISING $1.6B) at a whopping $38B valuation.

This makes the funding rounds by IOD’s own customer Snyk, at $300M with a now $8B+ valuation look like peanuts, not to mention other mega-rounds including JumpCloud’s $159M, OwnBackup’s additional $240M, and Lightricks $130M. OwnBackup immediately leveraging the funding to acquire RevCult, and JFrog is continuing on their buying spree now snatching up UpSwift to add to their acquisition portfolio.

Shhhh….IPO Coming…

Following the funding rounds and acquisition, a monthly ecosystem update isn’t complete without IPO announcements, but this one is still in the making. DevOps titan, Gitlab, has filed for the IPO, with an initial target date of November 2020, that has been postponed for nearly a year.