When the U.S. Department of Defense (DoD) announced late last year that Microsoft had won the contract for its Joint Enterprise Defense Infrastructure (JEDI) project (worth up to $10 billion), it rocked the IT world.

All of the leading contenders — Amazon, IBM, Oracle, and Google – were in the running, though smaller players were eliminated early on. But the ultimate choice of Microsoft came as a shock.

Azure beat out Amazon’s AWS in a surprise decision that, as of the writing of this article in 2020, Amazon continues to contest – so the final choice may still be up in the air. But while some say the decision was all about politics, the choice of Microsoft says a lot about the future of cloud and it should have everybody in the industry sitting up and taking notice.

What Is JEDI, and Why Does It Matter?

Joint Enterprise Defense Infrastructure (JEDI) is a U.S. DoD initiative aimed at transitioning massive security-related data to a cloud-based system system. The actual JEDI RPC was first floated after Secretary of Defense James Mattis visited Silicon Valley in 2017, met with Jeff Bezos, and returned inspired to modernize the nation’s defense infrastructure.

Following that meeting, Amazon cloud was considered the obvious front runner. After numerous delays, the DoD finally released its JEDI RFP in 2018.

Then there were numerous delays in the selection process, even after the early elimination of IBM and Oracle from consideration due to not meeting minimum contract requirements – and a lawsuit by Oracle claiming conflicts of interest in the bidding process. The DoD finally announced in August 2019 that Microsoft had been selected. Naturally, Microsoft stock immediately rose by up to 3% (though Amazon’s stock, apparently bulletproof, fell by less than 1%).

The JEDI contract is speculatively believed to be worth up to $10 billion. While actual figures have not been released, the Pentagon has set aside $61.9M for JEDI in its 2020 budget alone. Aside from the money at stake, the JEDI contract matters to everyone in the industry, not just Microsoft and Amazon shareholders.

There are a few reasons.

First, with the eyes of the world on the U.S. when it comes to security, the contract was especially important because any steps the U.S. takes will almost certainly have a ripple effect globally.

But more important, the decision makes a statement about the way the cloud universe should be built, going forward. To understand this better, though, let’s take a step back and look at the objectives of JEDI.

Interoperability, Edge Computing, and AI

Clearly, the requirements of the Department of Defense are going to be more complex in almost every way from those of a private company or organization. And the DoD has recognized this from the start.

DoD IT infrastructure was and is sorely lacking. According to one former DoD staffer, the organization is well behind the curve, given that some federal agencies, such as the CIA, made their first moves into the cloud in early 2013 (with AWS).

That’s left military decision-makers without the intelligence they need to make strategic decisions at the pace and scale of today’s geopolitics. As the DoD’s original proposal mentioned,

“In the absence of modern services, warfighters and leaders are forced to choose between foregoing capabilities or slogging through a lengthy acquisition, rollout, and provisioning process.”

According to a DoD rep’s statement to CNBC after the contract was awarded to Microsoft,

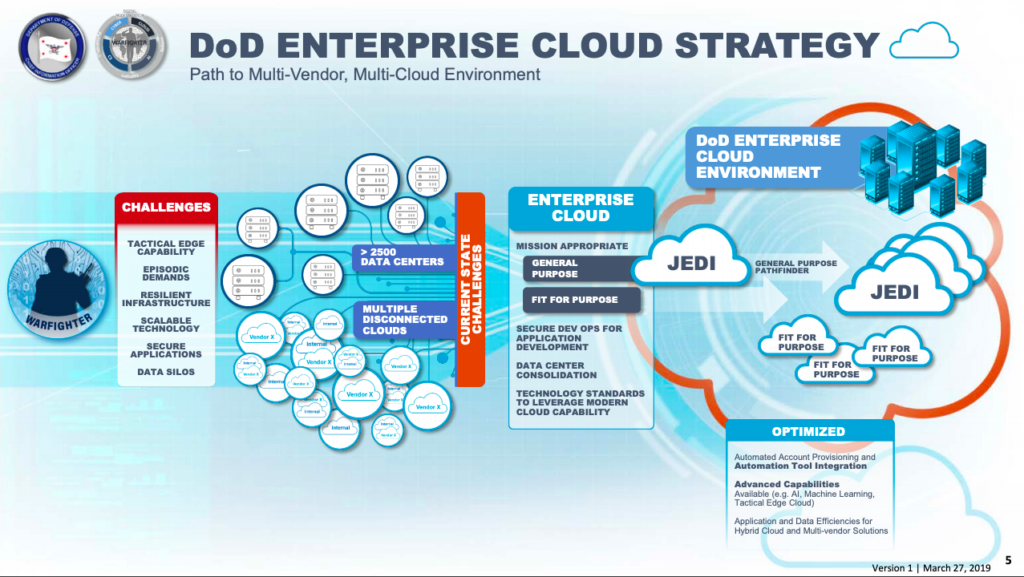

“The scope and complexity of DoD’s mission requires multiple clouds from multiple vendors. JEDI is one element of DoD’s overall multi-cloud strategy and part of larger efforts to modernize information technology across the DoD enterprise.”

Three main objectives emerge simply as a product of the complexity of rolling out a project on this scale.

First, interoperability is key. Any cloud platform chosen must be able to be integrated with other cloud providers. Vision for a multi-cloud future was always going to be an essential component of the winning proposal.

Second, the DoD understood that JEDI must be able to handle a massive range of edge devices to support a full range of military operations, including specialized equipment meeting military-grade specifications: “durable, ruggedized, and portable compute and storage” as well as “modular, rapidly deployable data centers.”

And third, the Pentagon needed to embrace an infrastructure that could optimally support AI and machine learning, applying these to defense strategies. The future of the country – and quite possibly of the world – is in no small way resting on the DoD’s choice of cloud provider.

Based on all this, the winning company would be responsible for upgrading the entire DoD IT infrastructure, making it “cloud” with an eye to global availability and performance, while also ensuring bulletproof security and ongoing monitoring to ensure the most advanced layers of cyber defense and encryption available.

Are you a tech marketing professional in need of expert-based content about cloud? We support top tech brands with exactly this challenge. Contact us.

So, Why Microsoft?

Amazon Cloud is the veteran in the field, with the most advanced offerings. In my opinion, they essentially invented the cloud, especially IaaS. Amazon is also known for its admirably tight customer focus. Many have tried and failed to emulate its speed at delivering new capabilities and features in response to users’ needs. As I pointed out here after re:invent 2019, the company’s culture revolves around an entrepreneurial, startup-like model: “run fast, be independent, and always keep looking ahead.“

Relative to AWS, Microsoft, on the other hand, is a newcomer to cloud – entering the market in 2010 compared to Amazon’s entry in 2006. The company brought its own cultural makeup to the table, which may have given it an edge in the case of the JEDI contract. To say that Microsoft is slow and enterprise-oriented compared to Amazon’s speedy, decentralized approach would be an over-simplification. Yet to some extent this particular comparison seems to repeat itself when looking at companies side-by-side.

In particular, two key differences between the companies’ approaches may have combined to give Microsoft an edge in this tough battle.

Enterprise Grade

First and probably most important is familiarity. This is certainly the most obvious explanation. In the cosmogony of computing, Microsoft rules as the “devil we know.” Microsoft’s Azure may be “the new kid on the cloud block,” but as a Microsoft platform, solidly based in a Windows Server ethos going back decades, it is a newcomer which is already in many important ways a known quantity.

Further, while Microsoft products may be widespread among users, the company has a deep and long history of engagement on an enterprise level. To come out of the starting gate guaranteeing compatibility with all Microsoft products and apps must have represented a powerful advantage.

For any Microsoft-based enterprise looking to build modern web applications and processes by combining Microsoft technologies, Azure provides a streamlined clear first choice. For example, a development team using Visual Studio could very simply and easily begin to evolve toward Visual Studio Team Services (VSTS), which integrates with Azure and Azure SQL to create a complete CI/CD pipeline.

Plus, development teams can leverage existing applications (build for running on Microsoft platforms) that are already integrated into Azure.

Additionally, for system administrators deeply versed in enterprise Windows, MS-SQL, the prospect of branching out into the unknown might seem either hopelessly challenging or an unnecessary waste of resources given the possibility of remaining on familiar territory with Azure’s famously cheerful, approachable interface

Hybrid Cloud

But perhaps a greater advantage Microsoft brought to the table is its demonstrated, powerful, and well-supported commitment to hybrid cloud. There are a number of compelling reasons behind the sudden popularity of hybrid and multicloud solutions, and by choosing a hybrid-oriented solution, the DoD is affirming this reality.

Microsoft premiered Azure Stack in 2017 to help organizations build and deploy hybrid applications from their own data centers – that is, extend Azure services and capabilities to the environment of their choice. Evolving in 2019 towards the Azure Stack Hub / Edge + Azure Arc integrated model (“hybrid 2.0”), Microsoft has repeatedly shown its willingness to respond to customer needs and bring the management of on-prem, edge, and cloud resources together into a single easily-managed Azure portal.

AWS, on the other hand, has shown itself to be less open to private or third-party cloud providers. Or rather, it has shown that its primary commitment is to public cloud, period. Which is not to say that Amazon hasn’t responded, simply that their response has been both less nimble and less adaptive to the reality on the ground than Microsoft’s. Not to mention that AWS Outposts, its primary answer to the question of hybrid cloud, is a relatively new element.

Interested to learn more on Hybrid Cloud? Google Anthos, Azure Arc, & AWS Outposts: The Race to Dominate Hybrid and Multicloud

Given that the ability to function and integrate environments in a multi-cloud world are factors specifically mentioned in the DoD proposal, this certainly must have given Azure an edge. And based on Microsoft’s long track record providing enterprise-level solutions, the DoD had reason to assume the company would continue providing responsive solutions to ever-evolving needs.

While Microsoft’s win of the JEDI contract is hardly a victory for a true underdog – since neither software behemoth can be called an “underdog” – there is a victory of sorts for a certain set of values going forward: a commitment to the future of hybrid/multi cloud, in a world of highly varied environments and devices, as well as an allegiance to familiar, time-tested interfaces and tools.

And where the DoD goes, the rest of the world large IT organizations may well follow.

Current Developments

Perhaps appropriately for a contract named JEDI, the battle isn’t over yet. Amazon made it clear from the start that it saw the bidding process as problematic and was planning to attempt to right this perceived wrong.

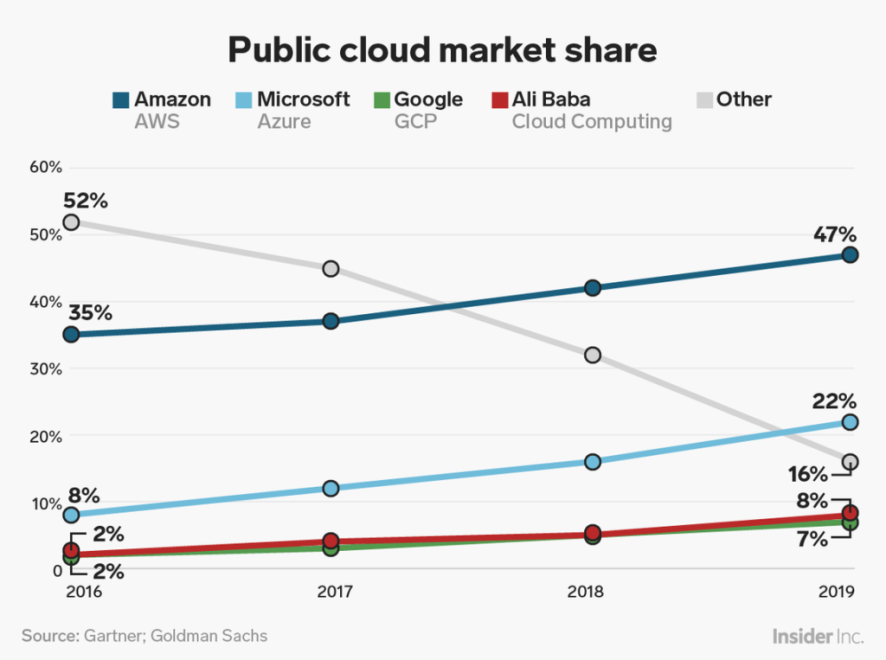

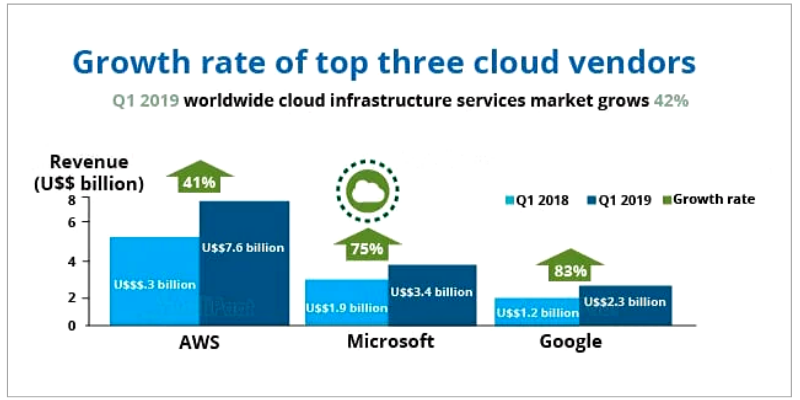

Predictably, Amazon officially filed suit in the U.S. Court of Federal Claims on November 22. In its suit, Amazon pointed to what it saw as clear deficiencies and errors in the evaluation process. For example, they have claimed that the DoD had failed to take into consideration the greater market share held by AWS over Microsoft Azure. As of February 2020, according to Canalys analysis, AWS holds 32.4% of the market, while Azure is only at 17.6%.

Yet those statistics overlook the fact that Azure has been growing at a much faster pace. While AWS’s revenue rose by 34% the last annual quarter, Azure’s revenue rose by 62%. And while AWS’s market share slipped from 33.4% to 32.4% between Q4 2018 and Q4 2019, Azure’s rose from 14.9% to 17.6% during the same period.

Finally, in February 2020, a federal judge blocked Microsoft from beginning work on the JEDI system pending final resolution of Amazon’s suit. The judge ruled that Amazon was likely to succeed on the merits of at least some of its claims. The suit does not mention rumors circulating that Amazon blames President Donald Trump’s personal bias against Amazon, nor other claims of undue influence, but instead around Microsoft’s “technically unfeasible” pricing scenario.

To some extent, the DoD has already given in and agreed to reopen bidding on controversial portions of the JEDI contract. This could lead to one particularly interesting outcome of the present standoff: a solution in which the DoD ends up splitting the JEDI contract between the two big contenders.

Good News for Cloud

Officially, the DoD has until August 17 to reconsider the lead contenders’ bids, but it seems likely that they may seek an extension from the court, buying themselves more time to review revised proposals.

So we’ll all have to wait until that decision comes through before we can evaluate the final outcome. In addition to the AWS/Microsoft angle, Google just made a sudden re-entry onto the playing field. Google Anthos, its multi-cloud management platform, has won a 7-figure bid for a DoD cross-platform cloud security contract, further underscoring the DoD’s commitment to a multi-platform future.

No matter what the final decision on JEDI winds up being, it will mean good news for the cloud world in terms of greater clarity going forward.

Naysayers have claimed that after all the delays getting the project up and running, the DoD will just get stuck behind the curve again, technologically, and wind up with a subpar system. Some even say that it would be better, at this point, to just pull the plug and start over with a new project.

But given that the winner will be at least one – and possibly both – of today’s cloud service giants, who have been constantly upgrading and updating their service offerings since before the DoD RFP was issued, it seems inevitable that the DoD will be the big winner however the award is ultimately determined. That’s because whichever way they turn, they’ll end up with an innovative, cutting-edge solution. For that reason, less depends on the eventual outcome of all the court battles than on the stated values of the DoD. These values may also be the secret behind Azure’s recent impressive gains in market share, as the rest of the industry, like the DoD, realizes what it truly wants: openness, interactivity, integration, familiarity.