I’ve been to all of the re:Invent conferences. Most of my time is spent on the expo floor—networking, talking with leading startups, and discovering new solutions and innovations.

This year, I had the pleasure to meet with the AWS partner network (APN) team in person. It was a great opportunity for me to learn about the APN, but also to share my views and experiences from within this great ecosystem of cloud partners. As one of the few independent AWS analysts, I paid close attention. AWS is working toward a goal of training millions of cloud professionals, and its partner network is the only way to reach that goal.

This has enormous implications on how AWS partners can stand out in an increasingly crowded network, stay in a harmonious partnership, and gain the attention of the APN team.

29 Million AWS Experts by 2025

AWS has a thriving partner network. Launched in 2012 with just a few hundred members, the APN has since grown to over 100,000 partner companies in over 150 countries.

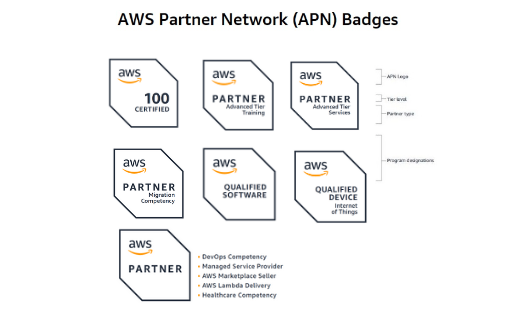

One reason the APN has grown so fast: AWS Partners can receive a badge as long as they have a solid offering and ability to showcase experience, knowledge, customer success, or technical validation of that offering. With a strong offering that benefits AWS customers—like a DevOps integration or automation service—the APN team is pretty likely to approve the partner and hand out the badge.

APN Badges (Source: AWS)

For some businesses, that’s all that matters. Get that APN badge, claim to be an AWS partner, and hope it pays off. But now that the partner network has crossed the 100K mark, that strategy is a lot less impactful. Nowadays, companies with a partner badge simply fade into the crowd.

AWS has provided other ways to stand out, of course. Partners that specialize in professional, advisory, or consulting services can augment their badges with Select, Advanced, and Premium Tiers, which help highlight a partner’s technical expertise and standing in the APN ecosystem.

I’m interested in what makes vendors true leaders in this space; which partners are capable of standing out. The short and simple answer is to see which companies are focused on certifications and competencies.

Back in 2020, Amazon announced an initiative to retrain 29 million people for cloud computing roles by 2025. This was an enormous goal, and it would be a challenge to reach it alone. That’s why Amazon has focused on educating the market through vendors, integrators, MSPs, and ISVs. These third parties are being strongly encouraged to certify their workforces on AWS. Not only does it help Amazon reach its lofty retraining goals, it grows the AWS ecosystem at the same time.

One of the best ways an Amazon partner can certify its workforce is to pursue Competencies. As a company gains Competencies (e.g., application security, data protection, compliance and privacy, threat detection and response, or infrastructure security), the team will need more people certified on AWS products and offerings. This is what makes the partner stand out as a leader, growing a connection with the APN team that can become a major source of business for the partner.

Lively Competition or Customer Obsession?

As mentioned, I’ve attended every re:Invent (seriously, every re:Invent), and my business is to know everything on the expo floor—which vendors are working together, what the ecosystem is like, and what trends are emerging.

Each year, vendors reach out to me with concerns about what AWS has announced. The vendor on the re:Invent expo floor tells me they came up with an idea that gained traction, but now AWS has launched a new product that might sink their business.

Instead of being a partner, AWS can feel like a competitor.

Past examples include CloudZero and Spot feeling the competition of Amazon Cost Explorer; or Redis wondering how the launch of Amazon ElastiCache for Redis would impact them. And even this year, for example, Quilt (Datahub) facing the launch of Amazon DataZone, which was released at this year’s re:Invent.

When people talk about AWS starting to compete in their space, their concerns are obvious. How are they supposed to compete with the top player in the industry, who happens to be the landlord who holds all the keys to the largest cloud garden? After each new launch, I’ve heard VCs claim they’ll reconsider investing, because AWS looks poised to kill the new startup.

Although I already know AWS’s perspective, I raised this point when I met with the APN team: AWS is the clear leader in the cloud market, so are those partners justified in worrying? Their answer was clear: Ultimately, AWS’s first leadership principle is Customer Obsession. That means the company will drive the market in order to create the best value possible for customers. Given the choice between serving partners and serving customers, AWS will make the customers the winners.

It’s easy to look at AWS and the partner network as “frenemies,” from a certain perspective, but in my opinion this is not the case. No one is an enemy in this play; it’s more of a friendly competition. AWS’s role is to help its partners improve, giving them access to their sales team, to AWS customers, and sharing its product roadmap. But in return, Amazon is not promising an easy path that’s free of competition. Being competitive is what pushes partners to innovate, develop faster, deliver faster, and build better features.

When you’re in competition with AWS, you’ll need to run faster. It’s not easy, but it’s possible! It’s about finding the perfect niche, because while AWS is a titan that can build services at scale, it’s much harder for them to dive deeply into each product. That’s where AWS partners find their opportunities.

One of the best examples of this balance is Redis (formerly Redis Labs). Today, an enterprise looking at Amazon ElastiCache might actually need a more robust offering—such as Redis Cloud, a competing solution that also runs on-premise and cross-cloud operations that AWS doesn’t support. Rather than being crushed by AWS, Redis has grown tremendously and reached a $4-5B valuation—all by delivering excellence in a specific niche.

So keep developing and specializing your product, compete with AWS where you need to, and focus on customers. Follow that formula, and if you succeed you’ll crush it the way Redis has. Eventually, the one who gains the most value is the end user.

In fact, I haven’t heard of any partner that’s failed because of AWS. It’s more likely to be the other way around: When AWS knows there’s a great product or service, they’ll refer customers to that partner. You’ll even find that AWS solution engineers introduce your service to clients, rather than the AWS alternative. That’s how absolute their commitment is to Customer Obsession.

Opening Up the AWS Garden

Analysts paid keen attention to the signals AWS gave at re:Invent 2022. It looks like AWS is opening up to integrations, vendors, and third parties when it benefits customers—”hybrid IT” is the term favored by AWS CEO Adam Selipsky.

A good example is AWS Systems Manager. This is an application that allows patch management of IT environments that can include other clouds. While AWS doesn’t bring any attention to that cross-cloud functionality, it looks like a sign of things to come. AWS DataZone is another example. It’s a system that gathers data from across the organization—including via API when it lives on-premises or in other clouds.

Finally, AWS solution partners are also delivering products cross-cloud or cross-environment. This helps vendors and partners move forward knowing they can open their product to other clouds. This change in AWS’s approach to hybrid IT was noted by Matt Asay, and he is exactly right about what’s happening.

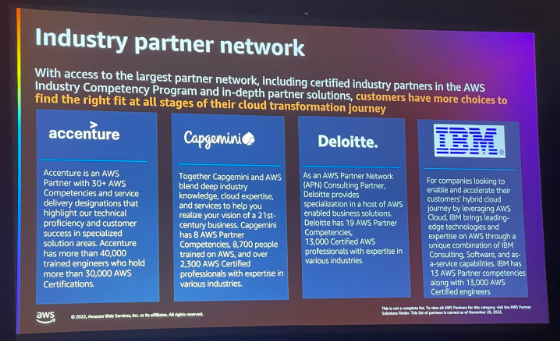

As the public cloud market matures and becomes mainstream, so does AWS. If you’d like more evidence of Amazon’s new openness, consider its willingness to collaborate and partner with IBM. On the one hand, IBM is a competitive IaaS vendor. But on the other hand, IBM has 13,000 engineers on staff who support IT clients on AWS migration and integration. Rather than shunning the company as a competitor, AWS seems more interested in opening up the garden.

AWS Industry Competency Program partners

The Culture Gap

One of my personal views that I shared with the APN team was the major gap between AWS and its partners when it comes to sales and marketing.

AWS has a beautiful online presence, with clear messaging. However, once a client is referred to a leading service partner, there is a good chance the “AWS experience” will fade. Partner websites can be poorly presented and their sales tactics are not always at the level AWS customers expect.

This misalignment is not in keeping with the high standards and the great culture AWS maintains across its own organization. I believe that AWS should invest and push its partners to better align their standards with AWS itself.

Become a Leading APN Player with IOD

AWS is looking for top-tier partners that are well positioned and add value. At IOD, we understand better than anyone how to help a company stand out in a very crowded pool.

Vendors are able to receive marketing investments from AWS. This type of marketing is mutually beneficial, with both teams gaining credibility and Amazon being incentivized to drive more business to the partner.

IOD is an intermediary player in this space. Almost all IOD clients are AWS partners, and they receive marketing budgets from AWS. For example, a company that spends $10k to produce a case study about the value of its partnership with AWS can expect Amazon to match that investment.

Once the budget is secured, the IOD team produces the case study content. Our team knows exactly how to create pieces that meet Amazon’s marketing standards. Beyond that, our team helps partners and service providers complete their competencies, position themselves as professionals in the cloud space, and receive recognition from AWS faster. IOD is, in that sense, a partner enablement vendor.

AWS Partner?

Start here: Contact us to evaluate your business and the opportunities available to you.