Amazon’s Nova family launched in late 2024 with significant momentum and strong early interest. A few months in, it’s a good time to assess how the offering is evolving and how it compares to other leading GenAI platforms.

In this post, I’ll start by examining how Nova stacks up against other major GenAI offerings out there. Then I’ll take a look at what’s changed since launch to better understand how Amazon is iterating—and how that reflects its broader GenAI strategy.

In Part 1 and Part 2 of this series about the state of AI in 2025, I explored the rise of AWS Nova and the emergence of Nova Act, Amazon’s agentic AI toolkit. But context matters. Generative AI isn’t a solo sport—it’s an arms race. That’s why, while Nova made an impressive debut, I still found myself wondering:

How does Nova really compare to OpenAI, Google Gemini, Claude, and Azure AI in the enterprise arena?

As someone who’s covered cloud and AI strategy for over a decade, I can tell you: The race isn’t about who has the flashiest demos. It’s about who’s offering usable, scalable, secure platforms that businesses can actually build on. So let’s look beyond marketing noise and early hype and instead dig into what really matters

The Big Picture: AI Is Platform Warfare

The four major players—Amazon, OpenAI, Google, and Anthropic—are all converging on the same goal: become the default GenAI layer for enterprise use. But their strategies diverge significantly:

- With its newly launched Nova models, Amazon is betting on low-cost, tightly integrated, multimodal infrastructure, and extending functionality with Nova Act for automation.

- OpenAI currently leads when it comes to reasoning, plug-in ecosystems, and trust, but the company is increasingly entangled in closed models and premium pricing.

- Google’s Gemini is a research-first powerhouse, strong on multimodal understanding and deeply integrated into productivity tools.

- Anthropic’s Claude is positioned as the safest, most context-rich LLM, and it’s often the best choice when considering alignment and long-document reasoning.

Beyond the core AI offerings, these leading providers are taking advantage of different routes to expand their offerings and provide more of a comprehensive ecosystem play through:

- Cross-”competitor” partnerships: For example, Anthropic has expanded beyond AWS and now offers Claude through Google Cloud. Additionally, Microsoft continues to foster its close relationship with OpenAI while simultaneously investing in Anthropic. Finally, cloud providers are integrating multiple APIs, for even greater flexibility in building and customizing the user’s ecosystem.

- Bundled enterprise offerings: For example, Google bundles Gemini with Workspace, Amazon integrates Nova deeply with AWS services, and Microsoft weaves AI throughout its enterprise stack. In this model, each player is pushing AI-powered productivity rather than just offering standalone models.

These movements signal that the real competition isn’t just between models but between comprehensive AI ecosystems.

But it’s one thing to look at the landscape from a distance. Let’s zoom in now and take a close, side-by-side look at some of the nitty-gritty details.

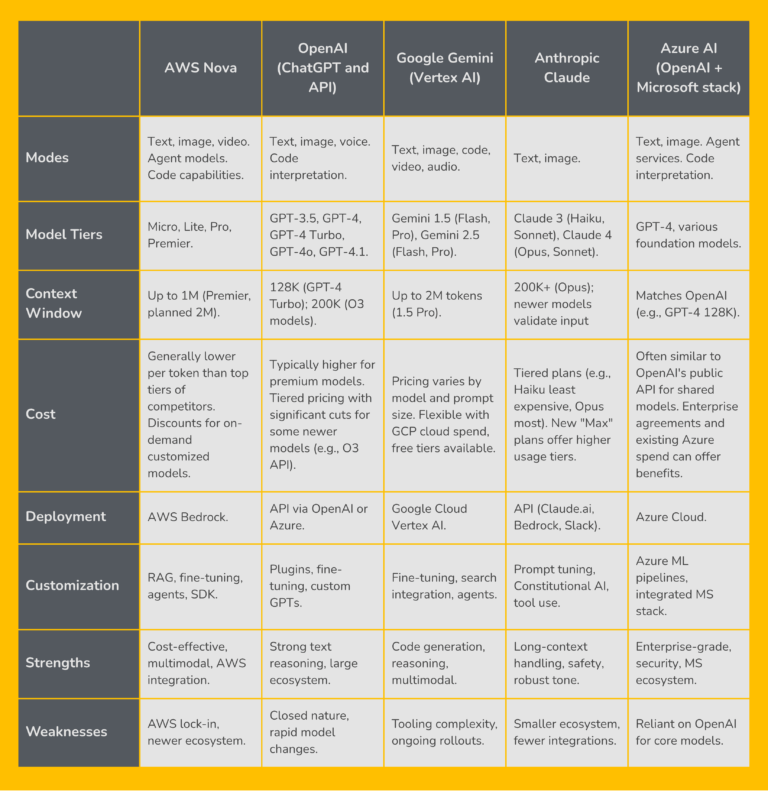

GenAI Platform Comparison: July 2025 Snapshot

Here’s a consolidated view of how AWS Nova compares to the other leading players across key vectors.

I’ve also added a column for Azure OpenAI Service, which gives users access to powerful language models like GPT-4, DALL-E, and more, for tasks like content generation, summarization, image creation, and chatbots within the Azure ecosystem.

This may offer advantages over OpenAI’s direct service, such as integration within the Azure ecosystem; disadvantages may include price and some users have reported problems with latency.

This comparison reflects a Western-oriented view. Although these models have traditionally outperformed those in China, South Korea, and other Asian countries, the gap is closing fast. China’s major models include contenders like Baidu, Alibaba, and, of course, last year’s top disruptor, DeepSeek. China aims to be a world leader by the year 2030, and with serious CCP backing, may well undercut Western contenders on price and performance in the very near future.

As for deciding which LLM might work best for your business, if you’re just looking for the nutshell version, you can skip the table and jump right to the next section, where I sum it all up and give my opinions.

Let’s take a look at how these players stack up head to head:

Top 3 Buzz-Worthy Developments on The Nova Scene

We know the AI field is moving fast. So just before we dive into our bottom-line take on trends to watch, here are our top picks for the most exciting developments in Amazon’s Nova family since its initial debut at AWS re:Invent 2024.

1. Nova Customization Capabilities (Including in SageMaker AI)

Nova calls its customization capabilities the most comprehensive of any model family. This range of customization options is now provided directly through Amazon SageMaker AI in the form of “ready-to-use recipes.”

These guided workflows and templates are optimized to help you customize Nova models to make them more accurate, relevant, and aligned with your specific business needs. It also enables tailored AI solutions for specific industries like healthcare and finance—and turbo-charges the speed needed to scale AI solutions, then deploy them seamlessly through Amazon Bedrock.

2. Nova Act SDK for Enterprise AI Agents

While the Nova Act SDK was part of the big Nova announcement back in March, it didn’t offer the most real-world functionality. And while its statistics were impressive, they didn’t reach high enough reliability levels for real-world deployment. That’s changing, and fast.

Improvements to the Nova Act SDK rolled out in July 2025 show impressive strides, possibly cementing Amazon’s role as market-leading agentic AI. Most significantly, Amazon claims that Nova Act now offers over 90% reliability on actual enterprise use cases.

The SDK has been iterated in part thanks to feedback from users. Amazon’s site now features additional real-world use cases that demonstrate this impressive performance. These will also help other enterprises visualize ways they might use Nova’s capabilities.

3. Amazon S3 Vectors for AI Workloads

AI applications like semantic search and retrieval-augmented generation (RAG) convert data into vector form. These vectors need to be stored in a vector database, and that’s led to a bunch of new third-party vector database vendors popping up. Now, AWS customers have a built-in native AWS storage solution. Using Amazon S3 Vectors promises to radically simplify vector-based storage and querying, and cut the cost by up to 90%.

Analyst POV: What Tech Marketers and Decision-Makers Should Watch For

Whether you read through the table above with interest or jumped right down here, you may still not have a clear picture of which LLM is best for your business’s needs. If you’re evaluating GenAI vendors, here’s my distilled guidance:

- Cost-conscious + AWS native? Nova is hard to beat. Especially if you plan to scale content generation, video creation, or agent automation across departments. You get power, speed, and control with less spend.

- Cost-conscious + AWS native? Nova is hard to beat. Especially if you plan to scale content generation, video creation, or agent automation across departments. You get power, speed, and control with less spend.

- Need bulletproof reasoning or plug-in extensibility? OpenAI still leads on that front, but at a premium. Worth it for sensitive applications or logic-intensive use cases.

- Focused on code generation or app-building? Gemini is surprisingly capable here. Google has quietly leapfrogged in coding agents and workflow generation.

- Need aligned, predictable dialog at scale? Claude remains a top pick. Its responses feel safer, more empathetic, and its context window makes it the go-to for long reports and evaluations.

- Locked into Microsoft 365/Teams ecosystem? Azure OpenAI is the most seamless way to embed AI into your stack. If you’re already deep in MSFT, this path reduces friction.

But perhaps the most important takeaway: There’s no single winner. Each vendor is evolving fast, and smart enterprises are taking a portfolio approach: experimenting across clouds, integrating the right model per task, and preparing for a multi-model future.

And if you read Part 2 of this series, you’ll also know that with Nova Act—Amazon’s new agent entry—though it’s still in preview form, we’re turning the page into a whole new chapter in the GenAI era.

All the major players have introduced agentic capabilities. And though most aren’t quite ready for prime time, they’re likely to make an impact on our choice of AI and LLM ecosystem.

Final Thoughts: The Era of AI Infrastructure Has Begun

With Nova, Amazon is doing what it does best: delivering reliable, scalable infrastructure with a developer-first mindset. And in the GenAI era, that infrastructure includes not just compute and storage—but reasoning, generation, and now, action.

For tech marketers, Nova opens up the ability to scale content operations like never before. For analysts and IT buyers, it’s a wake-up call: The old IaaS wars have morphed into AI platform wars, and everyone is competing on speed, cost, and intelligence.

As you consider which AI(s) to adopt, consider broader ecosystem factors, beyond just the models themselves: talent availability, community support, long-term strategic alignment. For example, AWS benefits from its massive developer base, but the specialized AI talent still tends to congregate around platforms with more open research practices and cutting-edge capabilities.

We’re only at the beginning. But if events since its release are any indication, Amazon Nova will be part of nearly every serious AI platform evaluation this year.

Will it become the backbone of your AI strategy? There are trade-offs, but with Amazon Nova, AWS seems to have finally positioned itself as a platform that lets organizations not only build with AI, but build on it.