By Tina Ornstein, IOD Senior Editor

Over the last five years or so, I have written dozens of business plans for early-stage companies and have personally raised money in the “traditional” way for my own start-up. When I first heard about ICOs (Initial Coin Offerings), I was immediately struck by the brilliance and power of floating a new cryptocurrency token in order to commercialize a blockchain venture, whose success would raise the value of the token for these initial investors.

Apparently my enthusiasm is catching :-), because ICOs have really taken off, and taken off fast. According to ICOData, there were 871 ICOs in 2017 with a total of ~$6.1 billion raised. In the first half of 2018, there have already been 867 ICOs, which have raised close to $5.5 billion.

One of the prerequisites of an ICO is a white paper — a document that outlines the venture’s blockchain technology, the team that stands behind the venture, and, of course, the business potential for the investors. Here I share with you what I consider to be the key success factors for writing a winning ICO white paper.

Understand the Investor Mindset

The first success factor is relevant not only to the writing of white papers, but to any equity fundraising effort: it is critical that you understand the mindset of the investor.

Simply put, where you see only opportunity, the investor sees only risk. So it’s your job to make sure that your white paper will lower the investor’s perception of risk or, put more positively, raise the investor’s confidence that your venture has a decent chance of succeeding.

Here are some ways to do so:

- Present a credible team, with the technology and business skills needed to execute the plan. Prior track records in successfully commercializing similar ventures should be flaunted shamelessly, if relevant.

- Get across as quickly as possible that you are meeting an unmet need and your business model will be appealing to your target audience.

- Somewhat related to the previous point, it’s important that your document shows convincingly that you have significant advantages over the competition.

- Have a clear and compelling rationale as to why blockchain and cryptocurrency are the best choice for your particular venture.

Do the Homework

I hate to be the bearer of bad news, but the success of your white paper (and your ICO!) is dependent on you buckling down and doing your homework.

You need to research the market, thoroughly map the competitive landscape, and ascertain a reasonable business model and growth rate based on industry benchmarks. You need to have a clear plan for completing the development as well as penetrating the market — and understand the costs involved in both. Put yourself in the shoes of the investor (see above), ask yourself tough questions — and go out and get the answers.

[iod-callout]

This homework is as important for you as it is for your potential investors. You, too, need to be 100% convinced that you have a compelling value proposition and the income vs. expenses numbers show that the latter is, ultimately, a lot less than the former.

Prepare the Elevator Pitch

I once read somewhere — and it has stuck with me ever since — that if you can’t easily and quickly explain something to someone else, it’s because you yourself don’t really understand it. That’s why before jumping into a white paper, it’s important that the entrepreneurs have internalized the information and insights gained while they did their homework.

If any one of them finds themselves in an elevator with a serious investor, they should be able to convey very coherently and clearly in no more than 60 seconds what they’re doing, why it’s better than what’s already out there, why they’re the right people to do it, and how they’re going to make money.

In effect, the elevator pitch is a vision and mission statement. Make sure the whole team is in agreement with it.

Balance Vision and Focus

On the one hand, you need to be excited about your vision, you need to have aggressive goals, and your white paper needs to be able to convey this to your potential investors.

But…you also need focus. You may have a platform with many possible applications and audiences, but you have to focus on an initial target application and audience and explain why that’s the correct choice. Your white paper has to be based on and present a plausible, defendable, prioritized work plan that takes you from where you are now to your first value-creating milestone(s). (For example, the first 10,000 active users, at least 100 partners in your marketplace, floating your token on at least 2 exchanges, etc.)

This balance is not easy. Entrepreneurs tend to be big on vision, but not so great at focus. However, if you can’t balance the two and convey that balance convincingly to investors, they will pass on your opportunity.

Pulling it Together

OK — you’ve done your homework, you have a kick-ass elevator pitch and your plan is impeccable. Now’s the time to jump in and write the white paper. Here are some tips:

- Create and follow an outline.

- Achieve the right tone — engaging but professional.

- It should look professional — clean layout, good graphics, callouts to highlight the key points, and so on.

- Make sure you cover the following key points, more or less in this order:

- A vision statement (“the pitch”)

- The problem you are solving and why current solutions are inadequate

- A detailed description of your solution and its benefits

- The team, including advisors, champions, and so on

- Status to date, with a focus on key achievements such as pilots, strategic partners already recruited, celebs who are endorsing your venture, etc.

- Competitive environment and your advantages

- The market opportunity, the business model and a P&L forecast showing how you will continue to capture value at scale

- The 12-18 month work plan that gets you to commercial launch and how much $$ you need to execute on the work plan

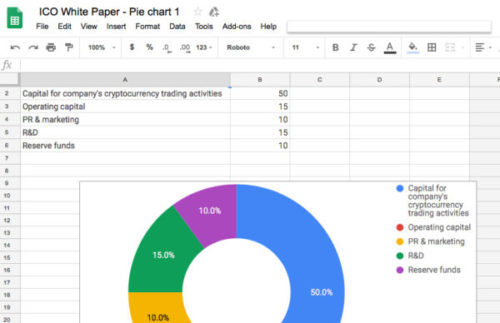

- The token and the terms of the ICO: What is the total number of tokens to be floated and will there be tokens added to the pool in the future? What percentage of tokens will be held by the venture and its founders — as a reserve and/or as an incentive? How many tokens will be issued in a pre-sale and at what price? When will public sales start, how many tokens will be made available, on which exchanges, and at what price? Will there be redemptions (or buy-backs)?

A Final Note

You can write the white paper on your own, but there are advantages when it’s done by an experienced third party.

First, they’re experienced 🙂 and can help you identify and close gaps. Writing the white paper becomes a consultative process, with the third party adding his/her expertise and knowledge into the mix. Second, you’re hiring bandwidth so it will actually get done, as opposed to the founder(s) trying to squeeze it in among a thousand other activities. Third, it adds credibility and gravitas to your venture if investors know that the white paper was done by a reputable third party.

Let us know if you need support in that effort because I or one of our other senior experienced IOD editors would be happy to work with you on it.